For Africa as an emerging economy continent, an unprecedented economic opportunity now exists. The shift in economic power away from the developed economies towards the emerging nations, and in particular the BRICS, puts Africa’s growing, resource-heavy economies into a position of great potential advantage. This is shown by the fact that, while Europe as a whole is still Africa’s largest trading partner, China has for the past couple of years overtaken the USA as the second biggest. As might be expected, this situation is mirrored by that of South Africa, the continent’s largest economy. The growing demand for resources by the BRIC nations, and stronger political ties between BRIC and many African countries, points to healthy growth in extra-African trade with the BRIC nations over the next few years.

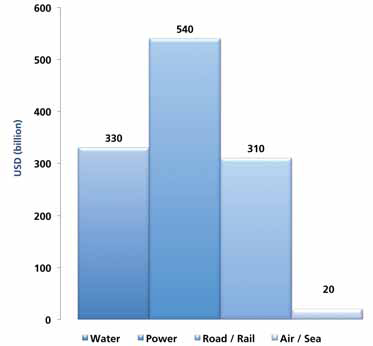

Investment by the BRIC nations into Africa, mostly by China, is focused on developing regional trade infrastructure – especially connecting key regional markets through road and rail, but also in water and power investments, as outlined below:

Estimated African Infrastructure Investment, 2010 – 2030

What potential benefits does the involvement of the BRIC nations in Africa hold for South Africa?

Increase in Political Weight

As the representatives of some of the largest importers and exporters of goods and commodities in the world, development of a united front between BRICS members grants the coalition significant political weight in global forums.

Increase in Export Demand

The current BRIC countries represent one of the most dominant importers of merchandise and commodities in the world, which could lead to a dramatic increase in the demand for South African commodities, and a consequent significant increase in the country’s export market and a balancing of its current account.

Increased Foreign Capital Inflow

The development of foreign investment policy between BRICS country’s could free up available foreign capital inflow for government funded infrastructure projects, allowing for a more rapid development of much needed base infrastructure, primarily energy, transport and water.

Increased Foreign Direct Investment

A decrease in trade and investment policy barriers is expected to stimulate increased FDI inflow into South Africa, particularly in the development of distribution channels for export to the greater African market.

Skills Transfer

Assuming foreign policy between the BRICS is structured in such a way that it allows for the transfer of skills through training and localisation mechanisms, South Africa could benefit tremendously through the development of a labour force with experience in world class technologies and business processes – something that chimes well with the needs of the local market.

On the other hand, the entry of the BRIC economies into Africa also represents a set of potential threats to the growth of the South African economy and the realisation of the benefits listed here. These include:

Inflation of Domestic Prices for Commodities

Substantially increased trade of commodities from South Africa to the rapidly growing BRIC economies could place inflationary pressures on domestic prices, restraining the development of the domestic manufacturing and raw material beneficiation market, already strained by increasing electricity tariffs. The resulting inflated prices of beneficiated or manufactured goods would not assist local industry due to its inability to compete with the local industries of larger BRIC nations, primarily India and China.

Relaxation of Trade Laws on Import Restrictions

The potential relaxation of trade laws on import restrictions from the East could further damage local industry through uncompetitive pricing, flooding the market with imported merchandise. The resulting shrinkage of local industry would cause significant job loss in the near term, negatively impacting government’s targets for job creation over the next ten years. This is already happening in the textile industry.

Overlaps in Primary Export Trade

The loosening of trade laws between the BRICS countries could further hurt South Africa’s export market due to

overlaps in primary industry trade with the larger BRICS countries, particularly in South Africa’s largest exports of agricultural goods, textiles and automotives.

Local Market for Heavy Manufacturing and Beneficiation Uncompetitive with India and China

Increasing electricity tariffs within South Africa are expected to drive tariffs to comparative levels with China and India by 2020, eradicating one of the countrys key advantages for investment. Favourable incentives for manufacturing, low wage costs, skilled and productive labour, a swelling domestic market, and low interest rates on lending, provide a more commercially viable market for investments in the other BRIC economies.

Given this macroeconomic context, we asked the respondents about their own objectives and constraints about moving into emerging market economies, in particular other African markets.

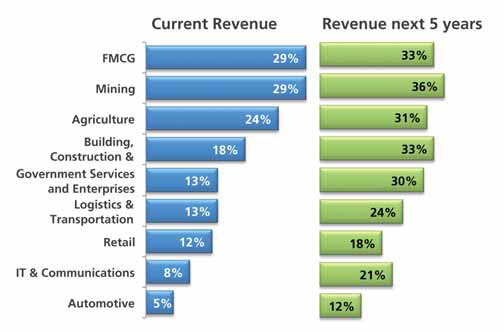

Revenue Generated in Emerging Economies

In all industry sectors where the research had adequate representation, revenue generated in emerging markets is expected to increase significantly in the next five years, pointing to South African business being ready to embrace the opportunities these relatively new markets offer. While some industries are hoping to more than double their revenue in these markets, probably off of a low base such as in the Retail sector, most industries are expecting increasing exposure to and revenue from these emerging markets.

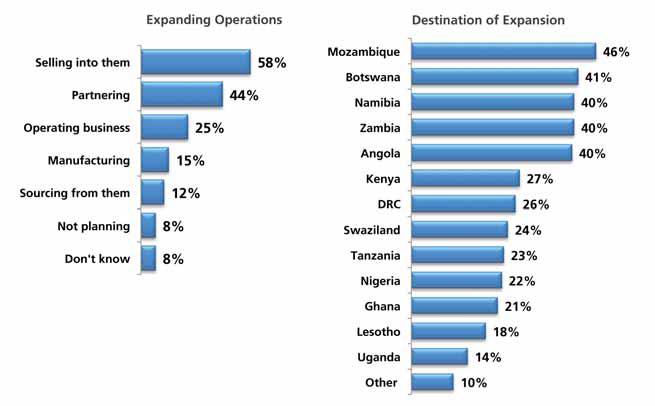

In terms of doing business specifically with emerging African markets, there is a concentration on selling into these new markets, or partnering with local businesses to do so, as well as a focus on expansion regionally, into the southern Africa, or, at most, the sub-Saharan African region. This tallies with the approach of the larger BRIC economies in establishing regional trade bases which can be linked via inter-regional trade infrastructure. However, it may be also a low-risk approach by South African-based companies selling into the regional market of the SADC where trade has existed for some time.

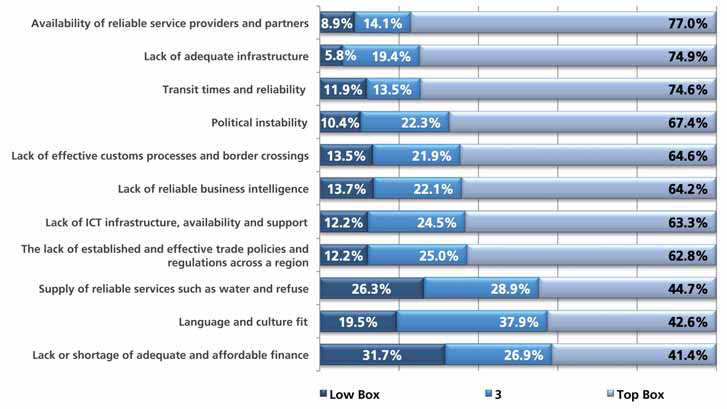

The other side of the emerging market expansion coin is the constraints that exist to doing business in these markets – especially in the rest of Africa. The constraints pointed to in the graph all reflect a relative lack of sophistication in other African markets that bedevils easy interaction with them. The lack of infrastructure, reliable services and processes are all factors that should be escalated from industry representative bodies to Government level, to be addressed from a policy perspective. This is a perfect case in point for the private sector to lobby effectively with Government to bring about the change required to mutually benefit the private and the public sectors.

Expanding into Africa - Constraints

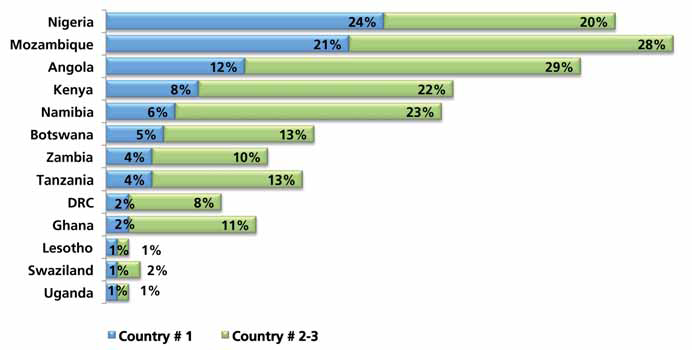

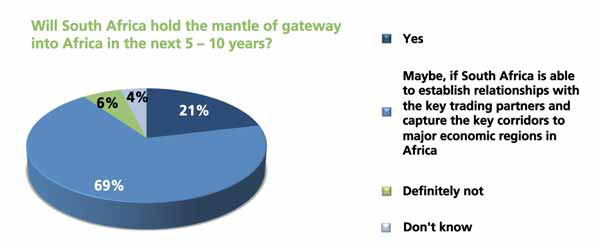

Our last slide shows the insight and circumspection that many of our respondents have about South Africa’s ongoing competitiveness. Despite the widespread assumption that South Africa is the continent’s economic powerhouse and the supply chain and logistics gateway to sub-Saharan Africa, the majority of the sample feel that this position is tenuous. Unless the country actively addresses trade competition and does something to develop trade corridors and capture market share in the southern African economic region, major competition from Mozambique and Nigeria, among others, will reduce the country’s market share. This is already being seen in the competition the Maputo Corridor represents for the Durban port on the East coast, for example. As we saw in the question about which countries in Africa we are likely to do business with, South Africa in fact sees itself as the gateway only to southern Africa, with Dubai in any case representing a better trans-shipment and logistics option for the North.

Gateway to Africa – competitors

SA – Gateway to Africa?

Conclusion: South Africa – growing up and moving on?

It is clear that the major focus of the world’s markets will continue to be the post-recession recovery and the economic crisis in Europe for the immediate future. The situation puts South Africa in an interesting position – while the national economy and growth prospects will no doubt be hurt by European fallout and further tail off in demand from our largest trading partner bloc, the South African economy is still fundamentally sound, and, with the turn to trade with emerging markets, even has real prospects for sustained growth.

What this year’s supplychainforesight study shows is that this position is more precarious than some might like to think. Emerging markets offer an opportunity, but also a set of very real threats. They include introducing cheaper labour and manufactured goods into our own market that will undercut local production, as well as consuming our unbeneficiated commodity resources, leading to further retarding of employment and skills in the local economy. Unless we can respond positively to those threats, our economy will stagnate. The study demonstrates that we clearly know what is required, and what holds us back, and that more professionally managed, world class supply chains are central to our efforts to grow and become more competitive.

The clear set of action points that emerge from this year’s research are as follows:

· There is a need to support and develop industries that will provide us with competitive advantage internationally.

· There is a critical need to align skills development and programmes to the needs of these and other industries to make them more competitive across the board.

· There is a need to organise industries more collaboratively, so that more effective lobbying and skills development can be realised.

· There is a critical need for private and public sector collaboration at policy formulation level, especially with regard to trade in African emerging markets, and trade with the other BRIC nations.

What our research demonstrates clearly this year is that industry is far more mature. The private sector seems ready for action on the critical constraints that might hinder the opportunities presented by the recent shifts in the global economic landscape towards the emerging economies. All that remains is for this call to action to produce concrete results.

For the full report, please visit www.supplychainforesight.co.za